The rapid growth of artificial intelligence has created demand not only for the companies building AI models but also for the infrastructure and tools that make this revolution possible.

These so-called “picks and shovels” stocks supply the hardware, software and services that underpin the entire AI ecosystem.

For investors, this approach offers a way to gain exposure to the AI boom without betting on which end-user applications will dominate.

By focusing on the enablers, it becomes possible to invest in businesses that benefit from broad adoption across industries.

Here are 7 “picks and shovels” stocks powering the AI boom and positioned to grow alongside the technology they help support.

| Company Name (Ticker) | P/E Ratio | Analyst Upside |

| Synopsys (SNPS) | 33 | 34% |

| Vertiv Holdings (VRT) | 32 | 15% |

| Super Micro Computer (SMCI) | 17 | 11% |

| Taiwan Semiconductor Manufacturing (TSM) | 21 | 10% |

| Arista Networks (ANET) | 48 | 8% |

| Broadcom (AVGO) | 41 | 6% |

| Micron Technology (MU) | 13 | -4% |

Unlock our Free Report: 5 undervalued compounders with upside based on Wall Street’s growth estimates that could deliver market-beating returns (Sign up for TIKR, it’s free) >>>

Here are 3 of the “picks and shovels” stocks powering the AI industry that analysts think are most undervalued:

Synopsys (SNPS)

Synopsys is a global leader in electronic design automation software and semiconductor intellectual property.

Its tools are used by chipmakers to design and verify increasingly complex integrated circuits, making the company a key enabler of innovation in semiconductors and artificial intelligence. In fiscal 2024, Synopsys reported revenue of approximately $6.1 billion, reflecting growth of about 15% year-over-year.

The company maintains a return on equity above 17% and continues to generate strong free cash flow, supporting ongoing investment in research and acquisitions. Its leadership in chip design software and secure IP makes it a critical part of the semiconductor value chain.

Value stocks like Synopsys in under a minute with TIKR’s new Valuation Model (It’s free) >>>

Vertiv Holdings (VRT)

Vertiv Holdings provides mission-critical infrastructure solutions for data centers, communications networks, and industrial facilities.

The company’s offerings include power management, thermal management, and IT management systems that support the growth of cloud computing and artificial intelligence. Vertiv reported 2024 revenue of approximately $8 billion, up 17% compared to the prior year, driven by strong demand in data centers.

Net income reached nearly $500 million, improving its profitability profile after prior restructuring efforts. With a growing order backlog and expanding margins, the company is positioned to benefit from long-term investments in digital infrastructure.

Track Vertiv Holdings’ financials, growth trends, and analyst forecasts on TIKR (it’s free)>>>

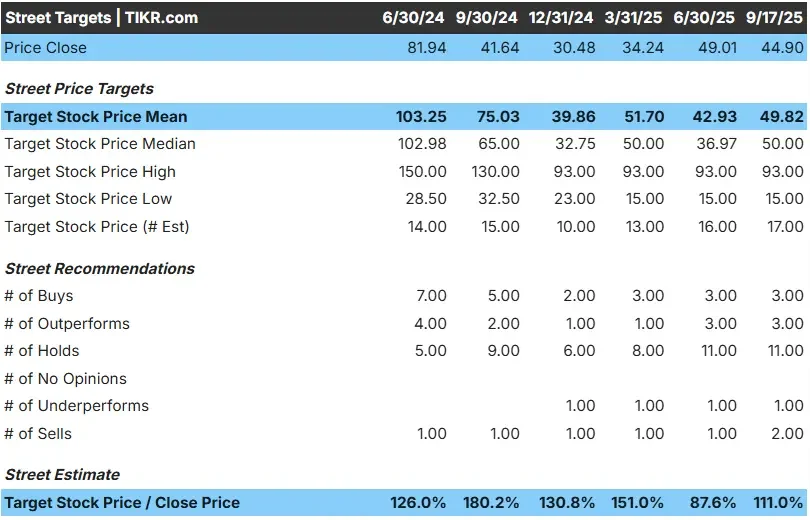

Super Micro Computer (SMCI)

Super Micro Computer specializes in high-performance servers, storage systems, and advanced computing solutions used in artificial intelligence, cloud, and enterprise applications.

The company has seen rapid growth due to surging demand for AI hardware, reporting fiscal 2025 revenue of roughly $22 billion, an increase of more than 46% year-over-year. Net income reached over $1 billion, highlighting strong operating leverage from higher volumes.

Super Micro has focused on delivering energy-efficient and customizable systems, giving it a competitive edge with hyperscale and enterprise customers. Its positioning in the AI-driven hardware market has made it one of the fastest-growing companies in the technology sector.

See if top investors & hedge funds are buying or selling Super Micro Computer right now (It’s free) >>>

Wall Street Analysts Are Bullish on These 5 Undervalued Compounders With Market-Beating Potential

TIKR just released a new free report on 5 compounders that appear undervalued, have beaten the market in the past, and could continue to outperform on a 1-5 year timeline based on analysts’ estimates.

Inside, you’ll get a breakdown of 5 high-quality businesses with:

- Strong revenue growth and durable competitive advantages

- Attractive valuations based on forward earnings and expected earnings growth

- Long-term upside potential backed by analyst forecasts and TIKR’s valuation models

These are the kinds of stocks that can deliver massive long-term returns, especially if you catch them while they’re still trading at a discount.

Whether you’re a long-term investor or just looking for great businesses trading below fair value, this report will help you zero in on high-upside opportunities.

Click here to sign up for TIKR and get our full report on 5 undervalued compounders completely free.

Looking for New Opportunities?

- See what stocks billionaire investors are buying so you can follow the smart money.

- Analyze stocks in as little as 5 minutes with TIKR’s all-in-one, easy-to-use platform.

- The more rocks you overturn… the more opportunities you’ll uncover. Search 100K+ global stocks, global top investor holdings, and more with TIKR.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!