Free cash flow, or FCF, is the cash a company generates after it accounts for outflows required to maintain business operations and support capital expenditures. Many investors consider FCF a better measure of profitability than net income or earnings, as it excludes non-cash expenses and accounts for capital spending and changes in net working capital (NWC).

Investors and analysts who analyze a publicly listed company’s performance might use variations of free cash flow, such as free cash flow to the firm (FCFF) and free cash flow to equity (FCFE), as every company’s capital structure varies.

Understanding free cash flow

Free cash flow is the amount of cash a business generates after paying for operating expenses and capital maintenance. Calculating FCF helps investors gain insights into a company’s financials, enabling them to make better investment decisions.

FCF is an important metric as it showcases how efficiently a company generates cash. Basically, after accounting for expenses and capital expenditures (CAPEX), a company should have enough money to:

- Repay debt and strengthen the balance sheet

- Reinvest in growth

- Pursue acquisitions

- Pay investors a dividend

- Buyback shares

A company that generates positive free cash flow provides it with the financial flexibility to improve shareholder wealth, making it an attractive choice for investors.

How do you calculate free cash flow?

The most common FCF formula is as follows:

What is the difference between net income and free cash flow?

Net Income and Free Cash Flow are essential financial metrics, but they serve different purposes and provide different insights into a company’s financial health.

Net Income is the profit a company earns after all expenses, taxes, and costs have been deducted from its revenue. It includes non-cash expenses like depreciation and amortization.

But, it doesn’t account for changes in working capital or capital expenditures.

Free Cash Flow is the cash a company generates after accounting for cash outflows to support day-to-day operations and maintain its assets. It is a cash-based metric that accounts for capital spending and changes in working capital, providing a more direct measure of cash generation and usage. FCF is used to assess a company’s liquidity and financial flexibility.

While Net Income provides a snapshot of profitability based on accounting rules, FCF offers a more practical view of a company’s financial health by showing how much cash it has actually generated or consumed.

What is the difference between FCFF and FCFE?

Free Cash Flow to the Firm (FCFF) and Free Cash Flow to Equity (FCFE) are metrics used to evaluate a company’s cash flow. However, they target different stakeholders and have distinct definitions and calculations.

Free Cash Flow to the Firm (FCFF)

FCFF represents the total cash flow available to all investors, including debt holders and equity shareholders, after covering all operating costs, taxes, and capital expenditures. It is also commonly called Unlevered Free Cash Flow (UFCF).

The formula to calculate FCFF is:

Characteristics:

- Referred to as the “unlevered” free cash flow since it doesn’t account for the impacts of leverage (debt).

- Useful for enterprise valuation as it represents total value to all providers of capital.

Free Cash Flow to Equity (FCFE):

FCFE represents the cash flow available to equity shareholders after all expenses, debt repayments, and necessary reinvestments have been made. It is also commonly called Levered Free Cash Flow (LFCF).

Characteristics:

- Known as the “levered” free cash flow, as it accounts for the impacts of leverage.

- Useful for equity valuation as it focuses solely on equity holders’ claims.

In essence, while FCFF gauges the total available cash for all investors (debt and equity), FCFE is the cash available specifically for equity shareholders. Both metrics are critical for analysts and investors in different contexts, with FCFF used in firm-wide valuations and FCFE in equity-specific scenarios.

So, any investor wanting to invest in the company’s shares or corporate bonds should analyze FCFF trends. A negative FCFF might raise concerns among investors as it suggests the firm cannot cover its operating costs and investments with its cash flows.

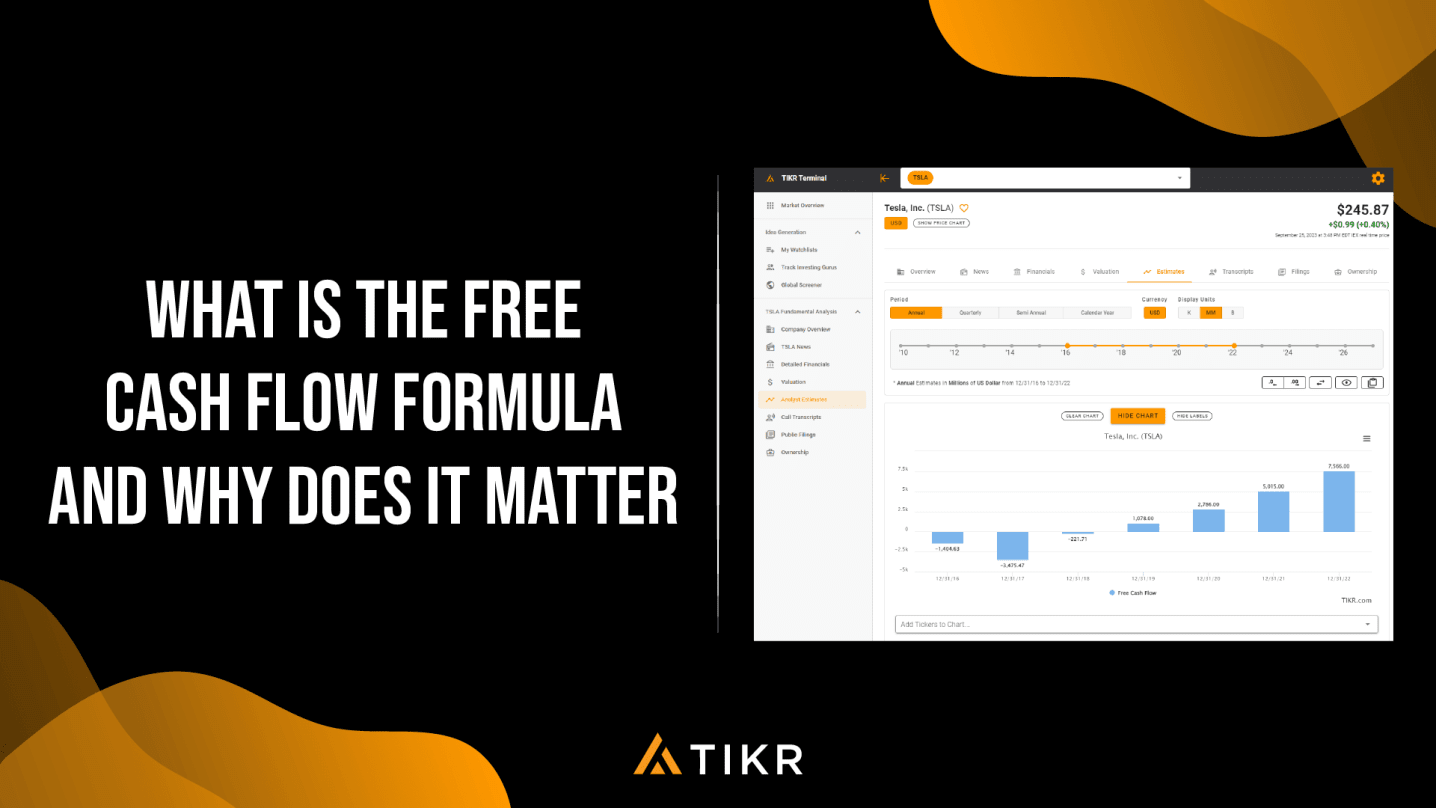

But you must dig deeper to see where the cash flows are allocated. For instance, a company with rapidly expanding operations like Tesla may have reported negative free cash flows for years before enjoying economies of scale. In fact, Tesla’s free cash outflows widened to almost -$3.5 billion in 2017. But it then went on to generate a positive FCF of $7.6 billion in 2022.

Tesla expanded its manufacturing capabilities in the past decade before reporting positive free cash flow in the last three years.

The importance of FCF in investment decisions

The value of a business is the discounted free cash flow it generates over its lifetime. The discounted cash flow (DCF) model is among the most popular methods to calculate the intrinsic value of a company.

The FCF of a company is tied to several components that include revenue growth, cost optimizations, operational efficiencies, dividend payouts, share repurchases, and debt.

If a company’s share prices have taken a hit, but its cash flows continue to rise, it may indicate the time is ripe to make an investment. Alternatively, a firm experiencing falling cash flows might suggest it is unable to self-sustain its business operations. It may force the company to increase debt to fuel its expansion, weakening its balance sheet in the process.

The Pros and Cons of Using FCF to value a stock

Advantages of using FCF

Free cash flow provides investors and analysts with various insights regarding the financial health of a firm. While a higher free cash flow is considered better, we have seen with the Tesla example that a negative cash outflow is not always a bad sign.

Free cash flow showcases the ability of a company to repay its debt and may be used to indicate future growth prospects.

FCF also can help you analyze a company’s business better. Operating cash flow includes variances in assets and liabilities, so we can see where the company cash is deployed and for what purposes.

For instance, if a company’s accounts payable have declined over the last few quarters, it might indicate the firm is paying its suppliers much faster. Similarly, a fall in accounts receivables might signify the firm is receiving customer payments more quickly.

The FCF metric:

- Filters out non-cash transactions and provides a realistic measure of a company’s ability to fund operations.

- Offers a clearer picture of a company’s financial health

- Is an indicator of future growth prospects.

- Is a better metric than earnings which can be manipulated with accounting techniques

- Indicates how efficiently a company converts revenue into actual cash

Disadvantages of using FCF

The major disadvantage of relying on FCF is that companies’ capital expenditures vary yearly and across sectors.

A company growing at a fast pace and expanding rapidly may have to allocate significant resources toward capital expenditures, which will lower its cash flows in the short-term. CAPEX can be lumpy and volatile, making it difficult to rely on FCF.

Additionally, high FCF numbers may suggest that a firm is not reinvesting in organic growth, which can negatively impact future cash flows.

The Key Takeaway

Free cash flow (FCF) is a vital metric for assessing a company’s financial health as it calculates the cash remaining after operating expenses and capital expenditures.

It’s often deemed more reliable than net income for evaluating profitability. Variants like Free Cash Flow to the Firm (FCFF) and Free Cash Flow to Equity (FCFE) provide deeper insights depending on the capital structure.

FCF gauges a company’s ability to repay debt, reinvest, and return value to shareholders. However, the metric can vary by industry and context and should be used as one of the many ratios to value a stock.